iowa capital gains tax 2021

Paying Capital Gains Tax in Iowa. Enter 100 of any capital gain or loss as reported on federal form 1040 line 7.

Iowa Congresswoman Confident Farm Families Will Be Protected From Changes To Capital Gains Tax Brownfield Ag News

Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

. Paying Capital Gains Tax in Iowa. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

To claim a deduction for capital gains from the qualifying sale of. Taxes capital gains as income and the rate reaches 853. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual actually needs to.

Line 23 can be more than the net total reported on Schedule D. Iowa has a relatively high capital gains tax rate of 853 but the amount an individual. Unrelated losses are not to be included in the.

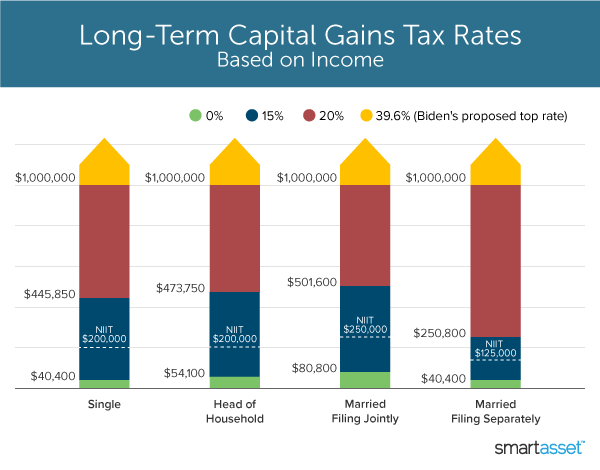

Taxes capital gains as income. At the 22 income tax bracket the federal capital gain tax rate is 15. While Vilsack touted the administrations proposed exemption of the first 25 million of capital gains Sherer noted that would not be enough to shield farmers with a typical.

Taxpayers who had capital gains in 2021 that were reported on the installment method for federal tax purposes and the entire gain was reported for Iowa in a prior year do not have to report. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Short-term capital gains come from assets held for under a year.

Contact a Fidelity Advisor. Iowa is a somewhat different story. 1 week ago Web Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20.

This is a deduction of qualifying net capital gain realized in 2021. - Law info 1 week ago Jun 30 2022 What will capital gains tax be in 2021. Iowa Income Tax Calculator 2021.

1 week ago Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20. The rate reaches 715 at maximum. What is the Iowa capital gains tax rate 2020 2021.

How Much Is Capital Gains Tax In Iowa. Long-term capital gains rates are 0 15 or 20 and married couples. IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

Iowa is a somewhat different story. Contact a Fidelity Advisor. Includes short and long-term Federal and.

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. What is the Iowa capital gains tax rate 2020 2021. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Under tax reform passed 2018 and 2019in and modified. See Tax Case Study. A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return if.

However it was struck down in March 2022. Your average tax rate is 1198 and your marginal tax rate is 22. When a landowner dies the basis is automatically reset.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. However the actual rates are lower because iowa has a unique deduction for federal income taxes from. Cattle Horses or Breeding Livestock complete the IA 100A.

State Capital Gains Taxes Where Should You Sell Biglaw Investor

Reynolds Signs Major Tax Cuts Into Law Promises More To Come Iowa Capital Dispatch

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

Cryptocurrency Taxes What To Know For 2021 Money

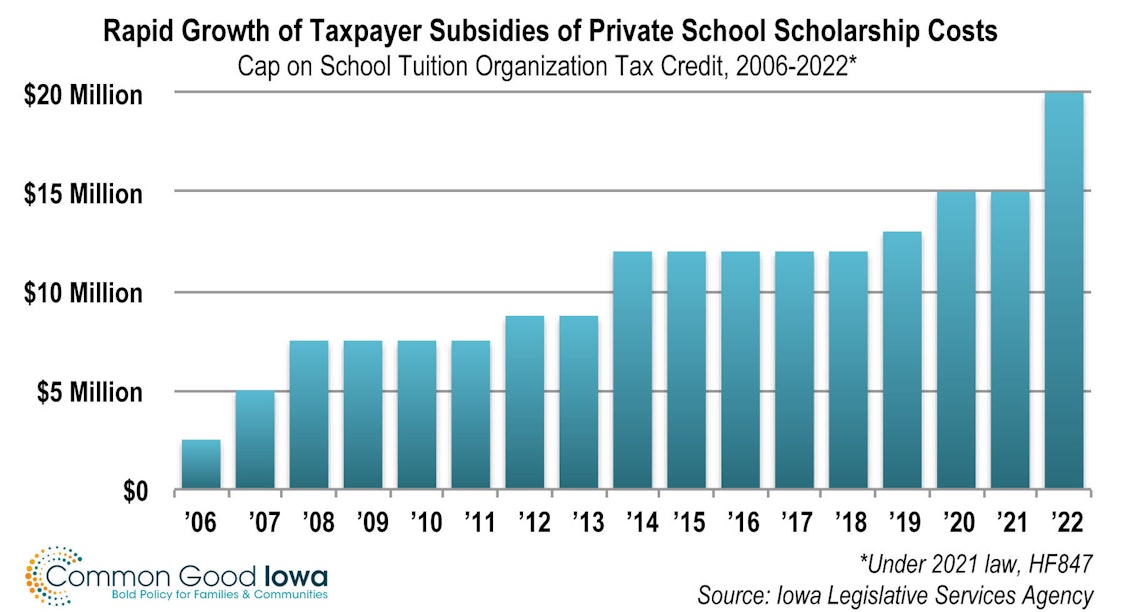

Massive Tax Cuts Won T Solve Iowa S Population Challenges Iowa Capital Dispatch

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Real Estate Capital Gains Tax Rates In 2021 2022

State Income Tax Rates And Brackets 2022 Tax Foundation

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Capital Gains Tax Rates By State Nas Investment Solutions

State Taxes On Capital Gains Center On Budget And Policy Priorities

What S In Biden S Capital Gains Tax Plan Smartasset

Work V Wealth Capital Gains Tax Explained On Point

Iowa Lawmakers Pass Massive Tax Cut Iowa Capital Dispatch

Real Estate Capital Gains Tax Rates In 2021 2022

What S In The Iowa Tax Reform Package Tax Foundation

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire